|

Key Takeaways: |

|

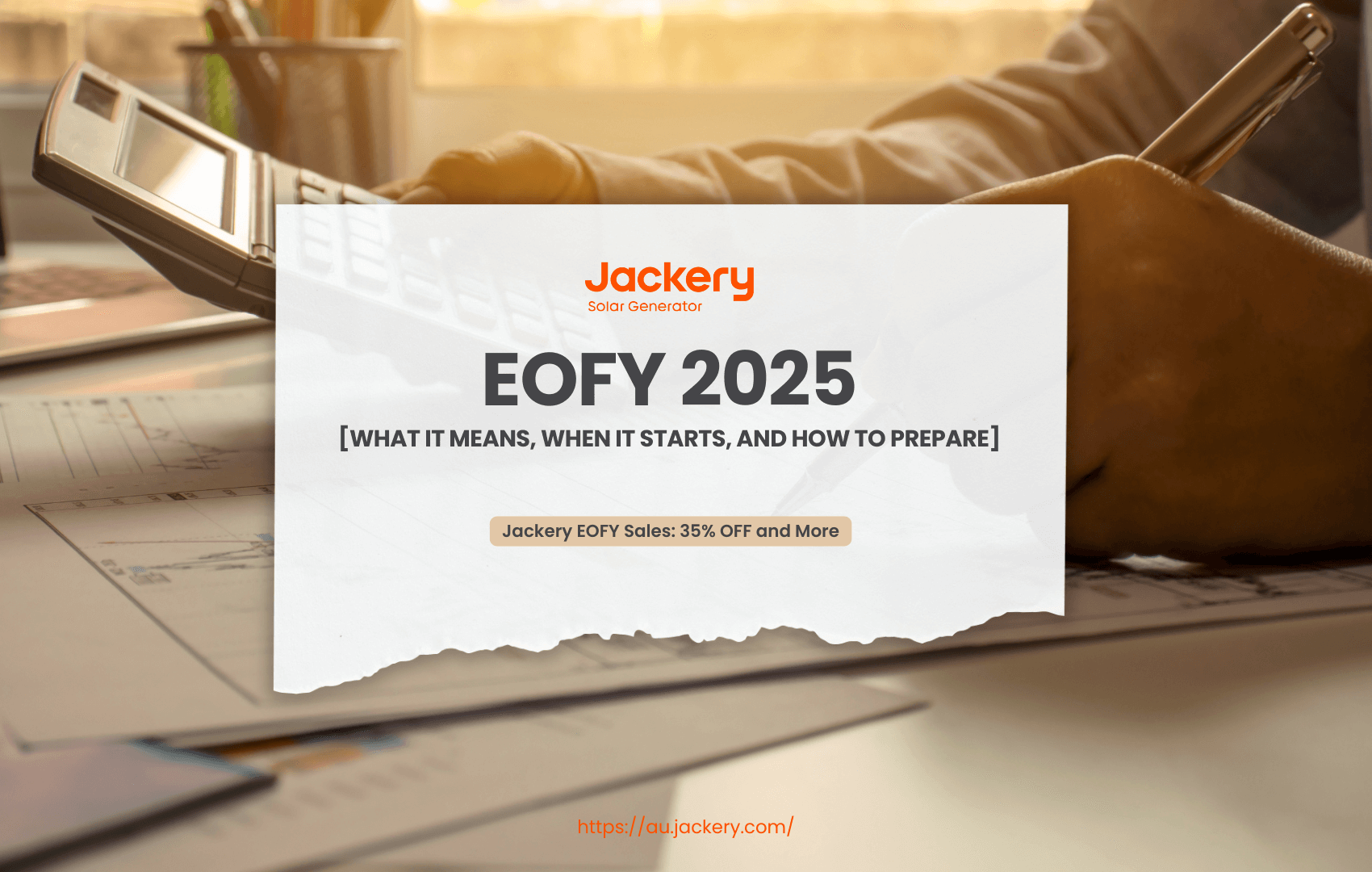

- EOFY 2025 refers to the end of the Australian financial year, which runs from 1 July 2024 to 30 June 2025. - Individuals and businesses must finalise their financial records, tax claims, and reporting obligations before or by 30 June. - Important EOFY dates include 30 June (EOFY), 14 July (STP finalisation), and 31 October (individual tax return deadline). - Consulting a registered tax agent early can help you stay compliant and take advantage of tax planning opportunities. - We highly recommend Jackery Solar Generator 2000 Plus and 1000 v2, which offer higher capacity and portability at a reasonable price in the EOFY sale. |

What Exactly Is the End of Financial Year (EOFY 2025)?

In Australia, the End of the Financial Year (EOFY) is a critical day in the financial calendar. Falling on 30 June, EOFY marks the end of one fiscal year and the start of the next. As the end of fiscal year 2025 approaches, individuals and organisations must grasp what this period includes and how to manage it efficiently.

EOFY is more than just closing the books; it's a legal and financial checkpoint. Businesses should conclude financial statements, reconcile accounts, complete payroll reporting, and prepare tax responsibilities such as Business Activity Statements (BAS) and income tax forms. Individuals can file a personal tax return, claim qualified deductions, and make last-minute payments to superannuation.

Timely EOFY preparation helps to assure compliance with the Australian Taxation Office (ATO), minimise penalties, and optimise tax benefits. It's also an excellent moment to evaluate financial performance, apply tax preparation measures, and make educated decisions for the coming year.

Whether you're running a business or simply filing your personal return, understanding EOFY 2025 and planning ahead of time can help you streamline the process and maximise any entitlements or tax breaks available.

When Is the Start and End of the Financial Year for 2025?

In Australia, the fiscal year runs from 1 July to 30 June. For the fiscal year 2024-25, this means that it begins on 1 July 2024 and concludes on 30 June 2025. Unless they have an approved replacement accounting period with the Australian Taxation Office (ATO), these dates apply to all people, sole traders, and enterprises.

This defined timetable provides consistency in taxation, reporting, and compliance. The End of the Financial Year (EOFY 2025) refers to 30 June 2025, the last day of the fiscal year. After this day, the next fiscal year (2025-26) begins, and the time for filing tax returns and other EOFY requirements opens.

It is crucial to note that while the fiscal year ends on 30 June, the tax return filing process normally begins on 1 July and might last into the following months, depending on whether you file yourself or through a registered tax agent. Individuals who file their own returns often have until 31 October to do so. Depending on the circumstances, businesses and those who use agents may have varying due dates.

EOFY Deadlines and Other Dates for Financial Reporting

Understanding the major deadlines for the End of Financial Year (EOFY 2025) is critical for being compliant and avoiding penalties. Whether you are an individual, sole trader, or business owner, putting these dates on your calendar can help you meet your tax, superannuation, and payroll requirements. Here's a rundown of key EOFY 2025 dates to keep you on track.

Key EOFY 2025 Dates at a Glance:

|

Date |

What's Due |

|

30 June 2025 |

The official end of the 2024–25 financial year. The last day is to process eligible transactions, finalise expenses, and make deductible payments. |

|

1 July 2025 |

The new financial year begins. Individuals can start preparing and lodging their tax returns. |

|

14 July 2025 |

Deadline for employers to finalise Single Touch Payroll (STP) data with the ATO. |

|

28 July 2025 |

Superannuation guarantee contributions for Q4 (April–June) must be paid by this date to avoid penalties. |

|

31 October 2025 |

The deadline for individuals lodging their tax return (without a registered tax agent). |

|

15 May 2026 |

Extended deadline for many individuals and businesses using a registered tax agent (check with your agent for your specific due date). |

EOFY Tasks Tied to These Dates

By 30 June 2025:

Make final tax-deductible purchases and super contributions.

Write off bad debts and obsolete stock.

Finalise business expenses and review accounts.

By 14 July 2025:

Ensure STP finalisation is submitted to the ATO so employees can access their income statements via myGov.

Reconcile payroll records, including PAYG withholding and super payments.

By 28 July 2025:

Pay your employees' super guarantee for the final quarter (Q4) to avoid missing the deduction cut-off and facing potential penalties.

By 31 October 2025:

If lodging your individual tax return without a tax agent, ensure all information is complete and submitted to the ATO on or before this date.

If you plan to use a tax agent but haven't registered with one before 31 October, you must do so by this date to be eligible for extended deadlines.

Ongoing BAS Deadlines:

Businesses registered for GST must continue to lodge Business Activity Statements (BAS) either monthly or quarterly throughout the year. The standard due date is the 28th of the month after the reporting period ends (e.g., 28 July for Q4 BAS).

Stay Organised with a Tax Calendar

The ATO offers a free Tax Time Calendar and Small Business Newsroom updates to assist you in keeping track of all lodgement and payment deadlines. Accounting software such as Xero, MYOB, and QuickBooks gives automated reminders and deadline-tracking capabilities to help you stay on track.

Keeping track of these crucial EOFY 2025 deadlines will help you stay completely compliant, avoid late penalties, and maximise allowable deductions.

Your EOFY 2025 Checklist

Without a structured approach, the end of the fiscal year (EOFY 2025) might be stressful. Whether you're an individual taxpayer, a sole trader, or a business owner, a clear EOFY checklist may help you keep organised, complete your requirements, and take advantage of possible tax breaks. To help you prepare, below is a complete EOFY 2025 checklist:

For Individuals

1. Gather Income Statements

Ensure your employer has submitted your income statement through Single Touch Payroll (STP). You can access this via myGov. Include other income sources such as bank interest, dividends, rental income, or government payments.

2. Review and Claim Deductions

Collect receipts and records for work-related expenses, such as uniforms, tools, home office costs, and travel. Include eligible deductions for self-education, charitable donations, and tax agent fees.

3. Maximise Superannuation Contributions

Consider making personal deductible contributions to your super fund before 30 June to reduce your taxable income. Check eligibility for government co-contributions or spouse contributions.

4. Organise Health Insurance and Medical Records

Ensure your private health insurance details are up to date to avoid the Medicare Levy Surcharge if applicable. Collect records of out-of-pocket medical expenses, especially if they relate to a disability or aged care.

5. Review Investments

Evaluate any capital gains or losses on shares, property, or other investments. Consider selling underperforming assets if it aligns with your strategy and tax planning.

For Sole Traders and Small Businesses

1. Reconcile Accounts and Finalise Financial Records

Ensure all transactions are entered and reconciled in your accounting software. Match bank statements, debtor and creditor balances, and inventory.

2. Finalise Payroll and Superannuation

Complete Single Touch Payroll (STP) finalisation by 14 July. Make sure super guarantee contributions are paid before 30 June to be deductible this financial year.

3. Prepare and Review Business Activity Statements (BAS)

Lodge any outstanding BAS and ensure GST records are accurate. Check for any eligible GST credits or fuel tax credits.

4. Write Off Bad Debts and Depreciating Assets

Review your accounts receivable and write off any bad debts.

Consider instant asset write-off or temporary full expensing for eligible assets purchased before 30 June (if still available under current legislation).

5. Review Trusts and Distributions

If operating through a trust, ensure trust resolutions for distributions are signed by 30 June.

Keep detailed documentation to support distribution decisions.

6. Conduct a Stocktake

If you carry inventory, perform a stocktake as of 30 June.

Write off obsolete or damaged stock where appropriate.

7. Review and Update Business Plans

Assess business performance against goals.

Prepare budgets and forecasts for the 2025-26 financial year.

|

General EOFY Tips |

|

|

Book Your Accountant Early |

Appointments fill quickly around EOFY, so get in early to secure expert advice. |

|

Use Cloud Accounting Tools |

Platforms like Xero, MYOB, and Reckon can streamline EOFY reporting. |

|

Stay Compliant |

Check ATO updates regularly to ensure you're aware of any changes in tax law or deductions. |

Being proactive with your EOFY 2025 checklist reduces stress, improves accuracy, and puts you in a better financial position for the new financial year.

Common Mistakes to Avoid This Financial Year

The end of the financial year (EOFY 2025) is a busy time - and costly mistakes are easy to make in the haste to meet deadlines. Avoiding these typical mistakes while filing a personal tax return or completing business paperwork will save you time, money, and unnecessary stress. The following are some of the most common EOFY mistakes made by Australians and how to avoid them:

Mistake 1: Leaving It Until the Last Minute

Delaying EOFY preparation frequently results in missing important tasks or providing incomplete data. This may result in penalties or missing deductions.

How to Avoid It:

Prepare yourself properly in advance of 30 June. During the month of June, you should schedule time within each week to arrange receipts, reconcile accounts, and evaluate financials.

Mistake 2: Failing to Keep Accurate Records

Insufficient paperwork or a lack of receipts can restrict the amount of deductions you can claim. It is possible for the ATO to reject claims if there is insufficient proof.

How to Avoid It:

You can use digital tools or apps to track and store receipts throughout the year. Ensure that the records are understandable, comprehensive, and kept for at least five years.

Mistake 3: Missing Deadlines

You may be subject to interest charges or fines if you fail to submit your tax returns, BAS, or payments to your retirement account by the specified date.

How to Avoid It:

Create reminders on your calendar for all of the important deadlines. If you are using a tax agent, you should make sure that you meet their earlier internal cut-off dates so that you can take advantage of extended lodgement times.

Mistake 4: Overclaiming or Claiming Ineligible Deductions

Claiming that personal costs are related to work or making educated guesses about the amount of deductions earned can result in audits or penalties.

How to Avoid It:

When in doubt, seek a tax professional's advice or use the online resources provided by the Australian Taxation Office (ATO). Only claim costs that are directly related to your income and to which you have appropriate proof.

Mistake 5: Not Finalising Payroll Correctly

Firms that fail to finish finalising Single Touch Payroll (STP) or incorrectly report employee wages could face compliance concerns.

How to Avoid It:

For the ATO's deadline, which is typically 14 July, you should make sure that all of the payroll data is accurate and completed. Before staying, make sure that payroll accounts and super payments are well-balanced.

Mistake 6: Overlooking Superannuation Opportunities

A great number of people either fail to make the most of their concessional super contributions before the end of the fiscal year or put off making payments until it is too late to be deductible.

How to Avoid It:

Please make your payments well in advance of 30 June. Check the annual contribution caps, and take into consideration making voluntary contributions in situations when they are tax-effective.

Mistake 7: Not Reviewing Asset Depreciation or Stock

Many times, companies fail to remember to monitor their asset register or to write off outmoded stock, which results in them missing out on authorised deductions.

How to Avoid It:

Before 30 June, you should do a stocktake and update the timetable for the depreciation of your assets. When it is suitable to do so, write off inventory that is older or damaged, as well as assets with little value.

Mistake 8: Ignoring Changes to Tax Rules or Thresholds

The laws governing taxes change from year to year. Relying on outdated information can lead to mistakes or missed opportunities.

How to Avoid It:

Stay up to date with the ATO's pronouncements, and speak with your accountant regularly, particularly around the time of the budget.

In the event that you are aware of these typical errors that occur throughout the end-of-year period and take preventative measures to avoid them, you will lessen the likelihood of incurring penalties, simplify your reporting, and position yourself for a more streamlined beginning to the 2025-26 financial year.

Jackery Solar Generators in This EOFY Sales

As Australia approaches its End of Financial Year (EOFY), smart shoppers have a prime opportunity to power up their adventures and preparations. Jackery, a leading innovator in portable power solutions, is joining the EOFY sales frenzy with a month-long event designed to deliver significant savings.

From 1 June to 30 June (AEST), the "Jackery EOFY Sale" offers Australian customers up to 35% off and more for some of the portable power stations and solar generators. This comprehensive sale goes beyond simple price drops, incorporating a "Buy More Save More" tiered discount system on all products, ensuring that whether you're gearing up for off-grid excursions, seeking reliable home backup, or simply looking for portable power for your daily needs, there's a deal to be had before the new financial year begins.

Here, we highly recommend Jackery Solar Generator 1000 v2 and 2000 Plus for this sales season!

Jackery Solar Generator 1000 v2

The Jackery Solar Generator 1000 v2 is set to be a fantastic deal during this Jackery EOFY Sale. The core promise of the Jackery EOFY Sale is substantial discounts across the product range. Given the "Solar Generator" designation, which typically bundles the power station with solar panels, the 1000 v2 will likely see a notable price reduction, potentially making it more affordable than usual.

Ideal Balance of Power and Portability: The Explorer 1000 v2 offers a generous 1070Wh capacity and 1500W AC output (with a 3000W surge). This makes it capable of running a wide range of essential Australian appliances for camping, caravanning, power outages, or even light job site use without being excessively heavy (around 10.8 kg) or bulky.

Rapid Recharging: Its ability to recharge quickly (as fast as 59 min in emergency supercharging mode or 95 min for a full charge via AC) is a major selling point. This means less downtime and more usable power, which is critical in dynamic outdoor or emergency scenarios. As a "Solar Generator," it's designed to pair seamlessly with Jackery SolarSaga 100W or 200W solar panels. Australia's abundant sunshine makes this a highly efficient and sustainable way to recharge the unit off-grid, extending its utility indefinitely for longer trips or remote living.

Long-Lasting LiFePO4 Battery: The inclusion of a LiFePO4 battery means exceptional durability with 4000 charge cycles to 70%+ capacity, translating to a lifespan of up to 10 years with regular use. This offers long-term value, especially considering the investment. ChargeShield 2.0 technology and various safety certifications (RCM, CE, FCC, UL, etc.) provide peace of mind for users in diverse conditions.

Quiet Operation: At less than 22dB, its whisper-quiet operation is a significant advantage over traditional gas generators, making it suitable for peaceful campsites or indoor use during power cuts. The Uninterruptible Power Supply feature ensures that sensitive electronics remain powered during power outages, making it a reliable backup for essential devices at home or in a mobile office.

Jackery Solar Generator 2000 Plus

The Jackery Solar Generator 2000 Plus is a significant investment, but during the Australian EOFY sales, its powerful capabilities and the potential for substantial discounts make it an even more compelling proposition.

Massive Capacity (2042.8Wh base): This isn't just for small devices. The 2000 Plus can power a wide range of high-demand appliances, from fridges and microwaves to portable air conditioners and power tools. This capacity is crucial for extended camping trips, RV adventures, or serious home backup during blackouts.

High Output (3000W Continuous, 6000W Surge): This impressive output means it can handle demanding electronics and even startup surges from motors. You won't be limited to just charging phones; you can run almost any household appliance. This is a key differentiator. The 2000 Plus allows you to add up to five additional battery packs, expanding its capacity from 2kWh up to 12kWh.

UPS Functionality (20ms): It offers an Uninterruptible Power Supply (UPS) feature. This feature ensures that essential appliances like refrigerators or CPAP machines remain powered seamlessly during grid outages, providing peace of mind.

Ultra-Fast Solar Charging: When paired with Jackery SolarSaga 200W solar panels (up to 6 panels can be connected), the 2000 Plus can be fully recharged in as little as 2.5 hours with sufficient sunlight. This is an incredible speed for a unit of its size, making it truly self-sufficient for off-grid living or extended periods without grid access, which is highly valuable in the Australian climate.

Durability, Longevity, and Safety: The use of LiFePO4 (Lithium Iron Phosphate) battery chemistry is a major advantage. It offers an exceptional lifespan of 4000 charge cycles to 70%+ capacity, meaning it's designed to last for over 10 years with regular use. This long-term reliability justifies the investment.

Enhanced Portability (for Its Size): While heavier than smaller units (around 27.9 kg), the Jackery Explorer 2000 Plus often includes built-in wheels and a telescopic handle, making it surprisingly easy to transport despite its high capacity. This design consideration is crucial for moving it around campsites, work sites, or during home emergencies.

Plan for the Coming Financial Year

The End of Financial Year (EOFY 2025) isn't just about winding up the previous 12 months; it's also an excellent opportunity to plan for the new fiscal year. Individuals and organisations can benefit from proactive planning by increasing cash flow, lowering tax payments, and laying stronger financial foundations for the coming year. Here's how to set yourself up for success in the 2025-26 financial year:

For Individuals

Tip 1: Set Financial Goals

Review your spending and saving habits from the past year.

Set clear financial goals for the new financial year. These could include saving for a home deposit, reducing debt, or building an emergency fund.

Tip 2: Adjust Your Tax Withholding

Use the ATO's tax withholding calculator to make sure your employer is deducting the right amount of tax from your pay.

If you received a large refund or had a payable amount this year, consider adjusting your PAYG withholding to avoid surprises next time.

Tip 3: Review Superannuation Strategy

Increase voluntary super contributions where possible to boost long-term retirement savings and benefit from tax concessions.

Review your super fund's performance and compare fees to ensure you're getting value.

Tip 4: Organise a Record-Keeping System

Use digital tools or apps to store receipts and records for deductions throughout the year.

Set a monthly reminder to categorise expenses, making next year's tax return easier to manage.

For Businesses and Sole Traders

Tip 1: Review Your Business Structure

Evaluate whether your current structure (sole trader, partnership, company, trust) still suits your financial goals, risk profile, and tax planning needs.

Consult a tax professional if you're considering restructuring.

Tip 2: Create or Update Your Business Budget

Prepare a detailed budget based on past performance, market trends, and new business goals.

Factor in planned expenses like equipment purchases, marketing campaigns, or staff expansion.

Tip 3: Forecast Cash Flow

Develop a monthly or quarterly cash flow forecast to anticipate shortages or surpluses.

Use this to guide decisions around financing, investment, or spending.

Tip 4: Review Insurance and Legal Obligations

Reassess your business insurance policies, including public liability, professional indemnity, and income protection.

Ensure all licences, registrations, and compliance documents are current.

Tip 5: Implement New Systems or Tools

Consider upgrading to cloud-based accounting software or automating manual processes. Streamlining operations early in the financial year can improve efficiency and reduce EOFY stress in 2026.

Note down all relevant ATO deadlines, such as BAS lodgement dates, PAYG instalments, and superannuation cut-offs. Use accounting software to set calendar reminders or automate compliance tasks.

FAQs about EOFY 2025

The following are the frequently asked questions about the EOFY 2025 in Australia.

1. What is the financial year 2025?

In Australia, the financial year 2025 is the 12-month period that begins on 1 July 2024 and ends on 30 June 2025. Individuals and businesses record their income and expenses during this time to file tax returns. At the conclusion of each fiscal year, taxpayers prepare and file their tax returns with the Australian Taxation Office (ATO), either independently or through a registered tax agency.

2. What date is the EOFY?

In Australia, the EOFY (End of Financial Year) occurs on 30 June of each year. The end-of-year date for the fiscal year 2025 is 30 June 2025. This is the last day to execute transactions, claim deductions, make super payments for the year, and ensure bank records are ready for tax season. It's an important deadline for corporations and individuals alike.

3. What is the fiscal year 2025?

In Australia, the phrases "fiscal year" and "financial year" are used interchangeably to refer to the accounting period used for government budgeting, company reporting, and taxation. The fiscal year 2025 is the same as the financial year, and it runs from 1 July 2024 to 30 June 2025.

4. What is EOFY sale in Australia?

The EOFY sale is a nationwide retail event in Australia that takes place during June and culminates on 30 June. Retailers across industries, including electronics, apparel, appliances, furniture, and automobiles, offer huge discounts as they clear out inventory before the end of the fiscal year. It is a popular period for consumers to make large purchases and corporations to acquire tax-deductible assets.

5. What is the biggest sale of the year in Australia?

While the EOFY sale is significant, the Boxing Day Sale on 26 December is commonly regarded as the largest sale of the year in Australia. It draws enormous crowds both in-store and online, and shops offer significant discounts in almost every category. Other notable sales include Black Friday, Click Frenzy, and End-of-Year, but Boxing Day consistently generates the most retail activity.

Final Thoughts

EOFY 2025 is more than just ticking boxes; it's an opportunity to regain control of your money and begin the next fiscal year with a solid strategy. Whether you're concerned with tax minimisation, compliance, or future growth, staying educated and organised is critical.

With a thorough checklist, a clear understanding of deadlines, and the necessary tools, you'll be well-positioned to avoid mistakes and maximise results. Don't wait until the last minute to prepare; start early, seek expert guidance as needed, and transform EOFY from a source of worry into a strategic benefit. Your future self will appreciate you.