|

Key Takeaways: |

|

- Submitting incorrect personal details, such as outdated bank information, can delay your tax refund. - Many Australians miss deductions by not tracking all work-related and home office expenses throughout the year. - Home office deductions must be supported with detailed logs or records to be valid. - A registered tax agent can help ensure you claim everything correctly and avoid common pitfalls. - We highly recommend Jackery Solar Generator 2000 Plus and 1000 v2, which offer higher capacity and portability at a reasonable price in the EOFY sale. |

Common EOFY Tax Return Mistakes and How to Avoid Them

As the end of the financial year approaches, many Australians rush to file their tax returns, but this haste frequently results in avoidable errors that waste time and money. Understanding the most common EOFY tax return mistakes and deductions will help you stay compliant while increasing your return.

One of the most common blunders is to rush the procedure. Many taxpayers file their taxes too early, without waiting for their income statements to be completed. This can result in discrepancies that require audits or delays. The Australian Taxation Office suggests that you wait until all of your information has been pre-filled and confirmed before lodging. Another common issue is failing to include all sources of income. This covers your wage, investment income, government payouts, and side hustle profits. Omitting income can result in future revised returns or penalties.

Claiming erroneous or invalid deductions is another big pitfall. Many people try to claim costs without keeping sufficient records or claim deductions for which they are not eligible. Some people, for example, try to claim personal expenses such as transport to and from work, which are often not deductible. Australians frequently miscalculate work-from-home deductions. Instead of properly applying the fixed rate method, people frequently guess or estimate their expenses. If not properly substantiated, this might result in inaccuracies or denied claims.

Another common mistake is failing to account for interest from bank accounts, dividends from stocks, or rental property income. These facts are frequently pre-filled but must be double-checked to verify accuracy. Failure to review pre-filled data may result in accidental underreporting. Many taxpayers also forget to keep receipts or do not follow a consistent record-keeping system. Legitimate claims, even if valid, may be denied without proof.

Finally, a serious oversight is failing to file a return or missing the deadline. Failure to lodge on time might result in penalties and interest costs that add up quickly. Slow down, double-check your information, and keep detailed records to prevent these frequent errors and guarantee your EOFY tax return deductions are correct and legal.

Are You Claiming the Wrong Deductions? Here's What You Need to Know

Incorrect tax deductions are among the most prevalent EOFY tax return errors made by Australians. A common blunder is classifying personal costs as work-related, which is ineligible. Many people overclaim deductions by overestimating work-related expenses or neglecting to separate personal and professional expenses appropriately. Without valid records, the ATO may reject these claims. Another common concern is the failure to preserve receipts; taxpayers who fail to keep evidence for their deductions may have legitimate claims disallowed. The ATO requires that records be retained for at least five years.

Taxpayers frequently make mistakes in income reporting, such as forgetting to record freelance income, investment returns, or government payments. Misunderstanding the tax-free threshold can result in inaccurate returns. Another trap is incorrectly categorising expenses, such as work-related travel or non-uniform attire. These are often not deductible but are frequently claimed incorrectly. Misunderstanding what is and isn't claimable, such as education expenses unrelated to your current job, might result in denied claims.

Other common mistakes include failing to keep up with changes in tax regulations, neglecting qualified deductions such as charitable donations or self-education fees, and failing to manage records properly. Many individuals underestimate the penalties and interest that come with filing tax returns late or missing deadlines. Some people believe that deductions decrease taxes dollar for dollar. However, this is a mistake; deductions reduce your taxable income, not your tax liability. Not using the ATO's resources or requesting assistance from a qualified tax agent might potentially result in missed opportunities or blunders.

Being aware of these difficulties, keeping proper records, and understanding what is legitimately deductible can all contribute to a more efficient and productive tax return process at the end of the fiscal year.

The Most Overlooked Tax Deductions You Might Be Missing Out On

Every year, many Australians miss out on significant tax deductions because they are unaware of what they are eligible to claim. Understanding these sometimes missed deductions can greatly impact your tax refund.

Tax Agent and Self-Education Expenses

Tax agent fees are one of the most frequently neglected deductions. If you engaged a registered tax agent to prepare and file your return last year, you can recover the expense in this year's return. Similarly, if you've taken additional courses to maintain or develop your skills in your existing employment, you may be able to claim self-education expenses. This can include course fees, textbooks, stationery, internet access, and even travel expenses directly tied to attending classes.

Working from Home and Professional Fees

With remote work becoming more common, home office expenses are now a major area where deductions are being overlooked. If you work from home, you may be able to deduct a portion of your electricity, internet, and phone costs and the cost of home office equipment. However, reliable record-keeping and calculations are required to support these claims.

Another often overlooked item is union fees and membership dues to relevant professional bodies. Premiums for income protection insurance policies maintained outside of superannuation are also deductible. People frequently forget that even little donations to registered charities—if they exceed $2 and include a receipt—can lower your taxable income.

Work-Related Tools, Equipment and Usage

Work-related expenses such as tools and equipment under $300 and car usage for work (excluding ordinary commuting) are also eligible if properly recorded. Subscriptions to industry-related magazines, phone and internet expenditures for business, and device depreciation are all routinely overlooked.

Investment, Rental, and Superannuation Deductions

There are other deductions that investors and landlords frequently overlook. These expenses include investment loan interest, management fees, rental property repairs and maintenance, and advertising charges. If you have made personal superannuation contributions, you may be eligible for a deduction as long as you meet certain qualifications and restrictions.

Tax Affairs and Miscellaneous Costs

Even the expenses associated with handling your tax affairs, such as flying to see a tax professional or purchasing tax reference materials, are deductible. You may maximise your return and avoid losing money by keeping detailed records and comprehending these less obvious deductions.

Work-Related Deductions: What's Legit and What Will Raise Red Flags

Claiming work-related costs is one of the most prevalent methods Australians use to increase their tax refund at the end of the fiscal year. However, getting it wrong—whether by claiming ineligible items, exaggerating amounts, or neglecting to keep correct records—can result in audits, penalties, or late returns.

The ATO has made it plain that it closely monitors work-related deductions, particularly where they appear disproportionately high or do not correspond to your industry. Understanding what is considered valid and what is not and how to avoid common pitfalls is critical for submitting your tax return confidently and accurately.

Understanding Legitimate Work-Related Claims

Every year, millions of Australians claim work-related deductions, but many are unaware that even little mistakes can result in ATO scrutiny or reduced refunds. To be eligible, expenses must have been incurred by you, be directly related to earning your income, and be supported by documentation.

Common Types of Deductible Work Expenses

Legitimate claims include work-related car and travel expenses (not commuting), tools and equipment, protective apparel, and uniforms. Working from home? You may be eligible to claim a percentage of your internet, power, and office equipment expenses. Self-education expenses are also eligible if they develop skills relevant to your current work. Union fees, professional memberships, and income protection insurance premiums are all deductible.

The Risks of Copy-Pasting Previous Returns

The Australian Taxation Office recommends against copying and pasting deductions from previous years without first checking their authenticity. Every tax return must represent your current employment condition. Identical claims from year to year can raise red flags and result in audits.

Avoiding Double Dipping on Claims

Double-dipping occurs when a taxpayer claims the same expense twice, such as using the fixed-rate method for working from home while also claiming internet or phone expenses. You must choose one way or face fines and changes.

Beware of Exaggerated or Ineligible Claims

Some taxpayers try to claim personal expenses—such as luxury items, gym memberships, or vacation travel—as work-related. These are not deductible and frequently result in ATO investigations or fines. All allegations must be reasonable and connect directly to your job.

Updated Rules for Working From Home Deductions

The fixed-rate system for working from home now includes phone, internet, power, and stationery expenses. To substantiate your claim, you must keep precise records of your actual hours worked at home as well as any related expenses.

The Importance of Proper Documentation

If you cannot provide paperwork to support your expenses, do not claim them. The ATO's systems can identify anomalous or unjustified claims, and fines may apply. If a claim fails the "pub test" — that is, it does not make sense when stated to a stranger - it is unlikely to pass the ATO examination either.

Avoid These EOFY Lodgment Errors That Could Delay Your Refund

Filing your tax return at the end of the financial year (EOFY) can be stressful, particularly if you want to receive your refund as soon as possible. On the other hand, simple errors during the loading process can cause unanticipated delays, hold up your refund, or even result in audits. Understanding the most common mistakes and how to prevent them can help you get your tax return handled fast and correctly.

Submit Complete and Accurate Personal Details

Submission of insufficient or erroneous personal information is a common issue that causes refund delays. Errors such as incorrect bank account information or obsolete contact information can cause payment delays, so double-check them before submitting.

Report All Income Sources

Many taxpayers fail to report all of their income sources, including informal work, investments, and government income. Omitting these can lead to altered returns and lengthier processing periods.

Claim Only Eligible Deductions With Proper Records

Incorrectly claiming deductions or exceeding permitted limits without adequate documentation frequently results in ATO audits. This slows down your refund, so save all of your receipts and only claim what you're due.

Accurately Report Residency and Marital Status

Residency and marital status are two factors that influence tax rates and offsets. If you provide erroneous information, your tax return can be complicated and delayed.

Provide All Necessary Supporting Documents

The Australian Taxation Office (ATO) may request further information from you if you do not provide payment summaries, receipts, or other supporting documentation. This prolongs the time it takes you to get your refund.

Lodge on Time to Avoid Penalties and Delays

Late lodging might result in penalties as well as interest charges being assessed. It also has the ability to delay any reimbursement that is owed to you. If you employ a tax agent, you should make sure that they receive your information in a timely manner so that they can fulfil the deadlines.

Use Updated Software and Review Your Return

If you use outdated software or enter information inaccurately into online forms, you can introduce problems that the ATO has identified. Before sending your return, you should check your numbers twice and thoroughly review each part.

If you avoid making these frequent mistakes while filing your taxes, you will increase the likelihood of receiving your EOFY refund in a timely manner and without any issues.

Your EOFY Checklist: Maximise Deductions, Minimise Mistakes

As the end of the financial year approaches, creating a comprehensive checklist can significantly affect how easily and successfully you file your tax return. Many Australians miss out on significant deductions or make preventable mistakes simply because they are disorganised.

By taking the time to obtain the necessary documents, track eligible spending, and understand what the ATO wants, you may maximise your tax refund while minimising the chance of costly mistakes or delays. This EOFY checklist will walk you through the necessary actions to help you stay on top of your tax obligations and claim everything you're eligible for.

Gather All Income Documents

Before you begin filing your tax return, make sure you have all of your income records. This comprises payment summaries, income statements, and records from all sources, including your primary job, casual or part-time work, bank account interest, stock dividends, and any rental income you may have received. Reporting all income sources precisely helps to minimise errors that could cause delays in processing your return or potentially ATO reviews.

Organise Work-Related Expense Records

Organising and keeping detailed records of all work-related expenses you wish to claim as deductions is critical. Uniforms, tools, protective equipment, and job-related self-education are examples of common deductible goods. To guarantee that the ATO accepts your claim, all expenses must be clearly related to your employment and accompanied by authentic receipts or invoices. Keeping your paperwork organised throughout the year makes tax preparation considerably easier.

Track Home Office Expenses

If you've been working from home, keep a detailed logbook or journal of your working hours and related expenses like electricity, internet, and office supplies. The ATO allows deductions for these costs, but adopting the correct computation technique, whether a fixed rate or actual expense, is critical. Accurate records and computations will help you maximise your claim while reducing the likelihood of an audit.

Include Insurance and Membership Costs

Examine your bank and credit card statements for payments connected to income protection insurance premiums, union dues, or professional memberships. These expenses are frequently deductible, and declaring them correctly can boost your refund. Keep evidence of payment as supporting documentation.

Claim Eligible Donations

Donations made to registered charities are usually tax deductible. Proper receipts for all donations are critical to back up your claims with the ATO. Even tiny donations might pile up and lead to a greater refund.

Avoid Common Deduction Mistakes

Many taxpayers make the mistake of overstating expenses or claiming personal expenses as work-related deductions. This can result in penalties or an audit from the ATO. To avoid these concerns, carefully evaluate your claims and confirm that all deductions follow the most recent ATO requirements. Only include expenses that are reasonable and directly tied to earning an income.

Consider Professional Help

If you're confused about how to maximise your deductions or wish to avoid mistakes, consult a qualified tax agent or professional tax service. These professionals can assist you in identifying extra deductions that you may be unaware of and ensuring that your tax return is complete and in compliance with current tax rules. Furthermore, tax professionals stay up to date on any new tax rules that may affect your claims, providing you with peace of mind throughout the fiscal year-end.

Jackery Solar Generators in This EOFY Sales

As Australia approaches its End of Financial Year (EOFY), smart shoppers have a prime opportunity to power up their adventures and preparations. Jackery, a leading innovator in portable power solutions, is joining the EOFY sales frenzy with a month-long event designed to deliver significant savings.

From 1 June to 30 June (AEST), the "Jackery EOFY Sale" offers Australian customers up to 35% off and more for some of the portable power stations and solar generators. This comprehensive sale goes beyond simple price drops, incorporating a "Buy More Save More" tiered discount system on all products, ensuring that whether you're gearing up for off-grid excursions, seeking reliable home backup, or simply looking for portable power for your daily needs, there's a deal to be had before the new financial year begins.

Here, we highly recommend Jackery Solar Generator 1000 v2 and 2000 Plus for this sales season!

Jackery Solar Generator 1000 v2

The Jackery Solar Generator 1000 v2 is set to be a fantastic deal during this Jackery EOFY Sale. The core promise of the Jackery EOFY Sale is substantial discounts across the product range. Given the "Solar Generator" designation, which typically bundles the power station with solar panels, the 1000 v2 will likely see a notable price reduction, potentially making it more affordable than usual. The Jackery Solar Generator is a combination of the Jackery Explorer 1000 v2 and SolarSaga 200W or 100W solar panels.

(*The working hours are only for reference; the actual working hours depend on your usage.)

Jackery Explorer 1000 v2 Portable Power Station:

Higher Output & Capacity: The Jackery Explorer 1000 v2 boasts a 1500W output with a 3000W surge, a 50% boost over previous generations. This means it can power a wider range of appliances, from portable refrigerators and coffee makers to some power tools and even small air conditioners. It has a 1070Wh (watt-hour) capacity, providing ample power for weekend camping trips, home emergency backups, or powering equipment on a job site.

Faster Charging: The 1000 v2 offers significantly faster charging times. It can go from 0% to 100% in just 59 minutes using "Emergency Super Charging" via the app or around 95 minutes with standard AC wall charging. This is a major improvement for quick turnarounds. The built-in UPS (Uninterruptible Power Supply) function allows for a seamless power switch in less than 20ms during an outage, making it suitable for sensitive electronics like computers.

Enhanced Safety: It uses a LiFePO4 (Lithium Iron Phosphate) battery, which is known for its longevity and safety. Jackery claims a lifespan of 4000 cycles to 70%+ capacity, translating to over 10 years of daily use. Features like ChargeShield 2.0 technology provide 62 layers of protection and UL certification, ensuring safety and durability.

Suppose you're looking for a portable power station with a solid capacity, fast charging, a long-lasting and safe battery, and a versatile output for a variety of uses (camping, emergencies, work). In that case, the Jackery 1000 v2 is a highly recommended option. The EOFY sale season presents an excellent opportunity to acquire this well-regarded unit at a potentially significantly reduced price.

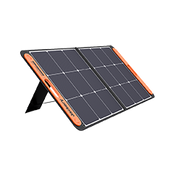

Jackery SolarSaga 100W Solar Panel:

Jackery SolarSaga 100W Solar Panel transforms solar energy into renewable power with this monocrystalline solar blanket! Boasting a solar conversion rate of 23.7%, it is optimally designed for outdoor activities and unforeseen power interruptions. The ETFE-laminated casing prolongs the solar panel's lifespan, and it weighs 4.69 kg. It is lightweight, foldable, IP65 waterproof, and convenient for transport for off-grid excursions.

Jackery Solar Generator 2000 Plus

The Jackery Solar Generator 2000 Plus is a significant investment. Still, during the Australian EOFY sales, its powerful capabilities and the potential for substantial discounts make it an even more compelling proposition. It combines the Jackery Explorer 2000 Plus with SolarSaga 200W solar panels.

(*The working hours are only for reference; the actual working hours depend on your usage.)

Jackery Explorer 2000 Plus Portable Power Station:

Massive & Expandable Capacity: With a 2042.8Wh (2kWh) capacity, the Explorer 2000 Plus can handle many essential appliances for extended periods, from refrigerators and microwaves to power tools. This is its biggest selling point. You can add up to five additional Jackery Explorer 2000 Plus battery packs, expanding the total capacity to an incredible 12kWh (a single unit + five battery packs).

High Power Output: It offers a substantial 3000W continuous output with a 6000W surge peak. This is enough to run most heavy-duty appliances and power tools, including some air conditioners, welding machines, and weeders. It comes with multiple AC outlets, USB-A (18W) and USB-C (100W) ports, and a carport, ensuring you can power a wide array of devices simultaneously.

Advanced & Long-Lasting Battery Technology: Like the 1000 v2, the 2000 Plus utilises a LiFePO4 (Lithium Iron Phosphate) battery. This chemistry is renowned for its safety, thermal stability, and long lifespan. Jackery rates it for 4000 charge cycles to 70%+ capacity, which translates to over 10 years of daily use. This means you're investing in a durable and reliable power source for the long haul.

User-Friendly Design and Features: Despite its large capacity and weight (around 61.5 lbs / 27.9 kg), it incorporates wheels and a telescopic handle for easier transport. However, reviews note the wheels are best on flat surfaces. It operates at a low noise level (around 30dB in silent charging mode), making it suitable for indoor use without significant disturbance.

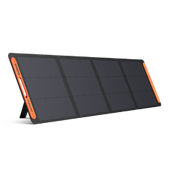

Jackery SolarSaga 200W Solar Panel:

The Jackery SolarSaga 200W Solar Panel boasts a solar conversion efficiency of up to 25%, facilitating rapid adoption of eco-friendly energy solutions. Its ETFE-laminated case prolongs its durability, while the suggested angle guarantees optimal sunlight absorption, rendering it an ideal power source for outdoor excursions and home backup. It is portable and collapsible and can be immediately connected to a power station for an optimal solar power system.

FAQs

The following are the frequently asked questions about the EOFY tax return mistakes and deductions.

1. What if I made a mistake on my last year’s tax return?

If you uncover an error on your prior year's tax return, you can request an amendment from the Australian Taxation Office (ATO). Individuals can file revisions electronically through ATO Electronic Services on myGov, submit a paper form, or send a letter outlining the correction. It is vital to know that there are time constraints for making changes, which normally last two years for individuals. If the adjustment results in a refund, the ATO will handle it appropriately; if it results in increased tax payable, it is viewed as a voluntary disclosure, which may lessen potential penalties.

2. What happens if you do your tax return incorrectly?

Submitting an inaccurate tax return might result in a variety of repercussions. You may face penalties, interest, or audits if the ATO finds differences. Common blunders include failing to declare all income sources, overclaiming deductions, and failing to keep proper records. However, if you proactively remedy the error by submitting an amendment, the ATO may consider it a voluntary disclosure, thereby lowering fines.

3. What is the most overlooked tax break?

Asset depreciation is a frequently overlooked tax deduction, particularly for property investors. Many investors fail to claim depreciation on their rental properties, resulting in considerable losses due to wear and tear on the building and its furnishings. Other frequently overlooked deductions include business-related transportation expenses, home office charges, and self-education expenses.

4. How do I remove an error from my tax return?

To correct an error in your tax return, use the ATO's online services at myGov. To make adjustments, go to your tax return, choose the appropriate year, and then click the 'Amend' option. Alternatively, you can send a paper form or a letter to the ATO explaining the correction. Processing timelines vary, with online modifications requiring approximately 20 days and paper requests taking up to 50 working days.

5. How to rectify an error in an income tax return?

To correct an inaccuracy in your income tax return, submit an amendment to the ATO. You can do this electronically using myGov by filling out the 'Request for adjustment of income tax return for persons' form or by writing a comprehensive letter to the ATO. Make sure you give the correct information and accompanying documents. Timely changes might help you avoid penalties and keep your tax affairs in order.

Final Thoughts

EOFY does not have to be a challenging experience if you know what to look for. You can maximise your deductions and speed up your return by being organised, understanding your claims, and avoiding common mistakes. Take the time to acquire the necessary papers, track all income sources, and only claim what you can prove. Using a tax professional can also help you avoid lost opportunities and compliance problems. Staying knowledgeable and prepared is essential for a successful tax return, whether you're filing for the first time or have been doing so for years. Begin early, keep exact, and aim for a seamless EOFY.